Example scenarios

Airline attracts public criticism

The situation

A global airline attracted public criticism after its crew stopped a customer boarding a flight. The customer, was wrongly thought by staff to have pushed one of their colleagues. Other passengers filmed staff refusing to board the woman. They posted the videos to social media saying they were shocked at her treatment by the airline.

The videos went viral, leading some people to say they would boycott the airline. The airline issued a statement to the press but was seen on social media as striking the wrong tone. Customers began to book with other airlines as the social media backlash grew.

How we could help

In such a scenario, we could help the airline recover. Our reputational crisis insurance includes a “customer abuse” provision in the standard wording that covers the reputational costs of adverse publicity caused by the mistreatment or abuse of a customer by an employee. This includes loss of gross profit as a result of the reputational damage, as well as the cost of crisis communications and brand rehabilitation.

Safety incident at tourist attraction

The situation

A high-profile tourist attraction hosted a carnival. A ride malfunctioned resulting in dramatic images and videos on social media. While no one was seriously injured and the media fairly and accurately conveyed that message, more people saw the social posts without any context leading to rumors and speculation that people were severely harmed or even died. The bad publicity resulted in the early closure of the carnival and reduced ticket sales for the tourist attraction.

In this scenario, the attraction’s public liability and property policies would cover all third-party costs. But those policies won’t cover the potential losses and costs caused by the reputational fallout from such an incident.

How we could help

We could help the attraction recover. Our reputational crisis insurance solution includes a “bodily injury” provision in the standard wording, which covers first-party reputational costs related to adverse publicity caused by a significant bodily injury event. This includes loss of gross profit as a result of the reputational damage, as well as the cost of crisis communications and brand rehabilitation.

All names, characters, and incidents portrayed in the case studies are fictitious. No identification with actual persons (living or deceased), places, buildings, companies, entities or products is intended or should be inferred.

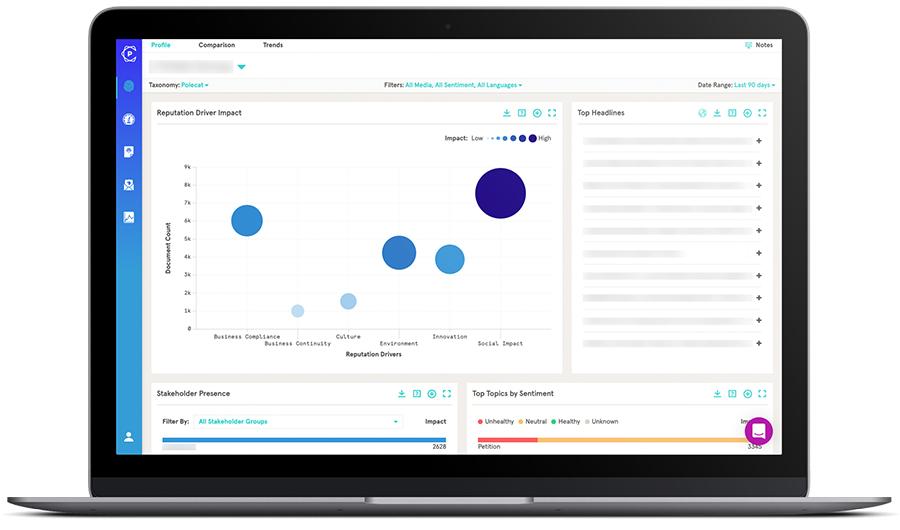

For more information about this solution or to request a demo of Polecat's online platform, please contact our specialist listed at the top of this page.

Disclaimer

WTW hopes you found the general information provided here informative and helpful. The information contained herein is not intended to constitute legal or other professional advice and should not be relied upon in lieu of consultation with your own legal advisors. In the event you would like more information regarding your insurance coverage, please do not hesitate to reach out to us. In North America, WTW offers insurance products through licensed entities, including Willis Towers Watson Northeast, Inc. (in the United States) and Willis Canada Inc. (in Canada).