The paid sick leave (PSL) law landscape is continually changing, resulting in new legal requirements that employers need to comply with. These laws generally allow employees to use PSL for certain reasons, such as to care for their own illness or that of a family member; for matters related to when the employee or a family member is a victim of domestic violence; or for work, school or daycare closings due to public health emergencies.

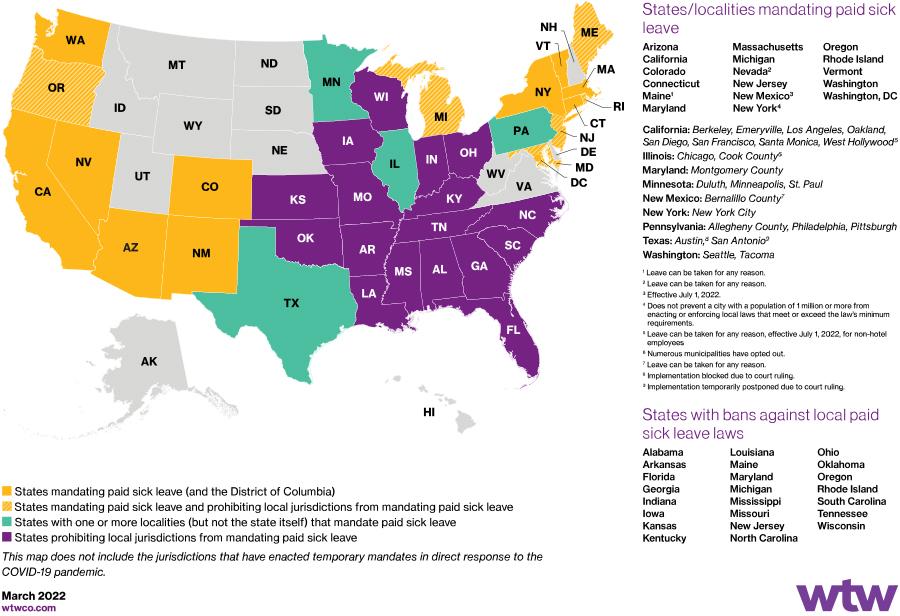

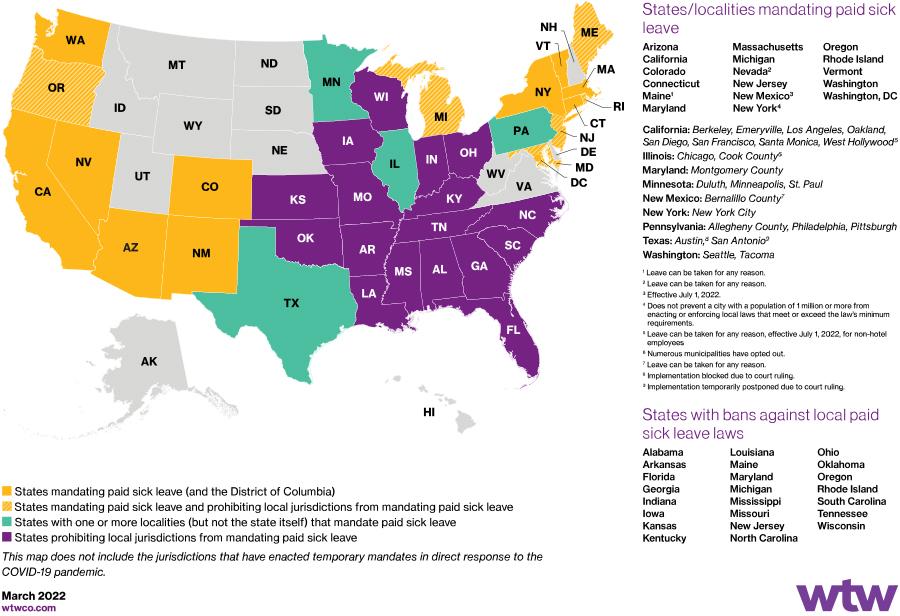

To date, 14 states, Washington, D.C., and over 20 localities have PSL laws in effect, while four jurisdictions — Nevada; Maine; Bernalillo County, New Mexico; and West Hollywood, California — have earned paid time off (EPTO) laws in effect that are structured similarly to the PSL laws but allow employees to use leave for any reason.

The following state and local developments have occurred since our last update1 that employers must now navigate if they operate in these jurisdictions:

- Allegheny County enacted a new PSL ordinance requiring employers with at least 26 employees to provide up to 40 hours of paid leave that employees can use for their own personal illness, to take care of sick family members, for when the employee’s workplace or child's school/place of care is closed for public health reasons, or to care for a family member due to his or her exposure to a communicable disease. Employees accrue one hour of PSL for every 35 hours worked, up to 40 hours a year. Allegheny County is the third jurisdiction within Pennsylvania with a PSL law, joining Pittsburgh — which is located within Allegheny County — and Philadelphia. The new law took effect on December 15, 2021; however, fines will not be imposed until December 15, 2022.

- Chicago amended its PSL ordinance to expand and clarify additional uses of PSL, such as caring for a family member whose school or place of care was closed; compliance with public health orders; and reasons related to a family member’s mental and behavioral health, including substance use disorders. The amendments took effect August 1, 2021.

- Colorado revised its wage protections rules to clarify the requirements on vacation and paid time off payout. While the Healthy Families and Workplaces Act (HFWA) defines PSL as wages, it does not require payment of unused PSL upon separation. Effective January 1, 2022, the wage protection rules specifically define vacation pay as “…pay for leave, regardless of its label, that is usable at the employee’s discretion (other than procedural requirements such as notice and approval of particular dates), rather than leave usable only upon occurrence of a qualifying event (for example, a medical need, caretaking requirement, bereavement, or holiday).” The revised rules clarify that if accrued PTO — regardless of its label — is usable for vacation, then it is “earned and determinable” and must be paid at termination rather than forfeited, even if the leave can be used for other reasons. As such, employers using a policy or agreement to satisfy HFWA’s requirements that can be used at the employee’s discretion must pay out any accrued leave at separation of employment, effective January 1, 2022.

- Duluth, Minnesota, expanded its Earned Safe and Sick Time (ESST) ordinance to provide use of paid sick time due to the closure of an employee’s place of employment for public health reasons. The amendments also imposed new requirements that employers provide new employees with a copy of their ESST-compliant paid-leave policy and, if an employer maintains a handbook, a copy of the ESST-compliant policy. The amendments became effective on August 19, 2021.

- New York adopted regulations interpreting the state’s PSL law that had been proposed two years earlier. While the December 2020 proposed PSL regulations were adopted with no changes, the Department of Labor clarified several key issues. Notably, employers should count the number of employees nationwide in determining the number of employees, requiring advanced notice for foreseeable use of PSL is not permitted, and there’s no limit of unused PSL — whether earned or frontloaded — that employees can carry over to the next year.

- West Hollywood, California, enacted a new ordinance requiring employers to provide up to 96 hours of paid time off to full-time employees that can be taken for illness, vacation or personal necessity. Once this leave is exhausted, employers must provide an additional 80 hours of unpaid sick time for the illness of the employee or the employee’s immediate family member. Both the paid and unpaid time off is prorated for part-time employees. Employees can accrue paid time off until they reach 192 hours, at which point employers must pay employees once every 30 days for accrued time off over the 192-hour threshold. Also, employers may allow employees to cash out accrued time off under the maximum. The ordinance went into effect on January 1, 2022, for hotel workers and will go into effect for all other covered workers on July 1, 2022.

For a current listing of all the states and localities with PSL and EPTO laws, see the map below. Absent a federal mandate, changes at the state and local level are expected to continue.

while four jurisdictions — Nevada; Maine; Bernalillo County, New Mexico; and West Hollywood, California — have EPTO laws in effect.

States and localities with PSL and EPTO laws, as of March 2022

Going forward

Covered employers in states and localities with PSL and EPTO laws should review their existing leave policies and procedures to determine whether they are in compliance with the laws in the jurisdictions in which they operate and adjust their employee leave policies if necessary. Federal contractors will also need to comply with Executive Order 13706 and the related regulations.

Footnote

1 See “State and local paid sick leave law developments,” Insider, July 2021.