NEW DELHI, June 22, 2022 — A majority 64% companies in India expect significant impact on their P&L as a result of the anticipated changes in the labour code. In light of regulatory changes, labour reforms and increasing cost of providing retirement benefits, 53% of organisations in India are considering or have planned to review their retirement or long-term benefits design in the next two years. These are among the findings from the State of Retirement Benefits Study in India by WTW (Willis Towers Watson, NASDAQ: WTW), a leading global advisory, broking and solutions company.

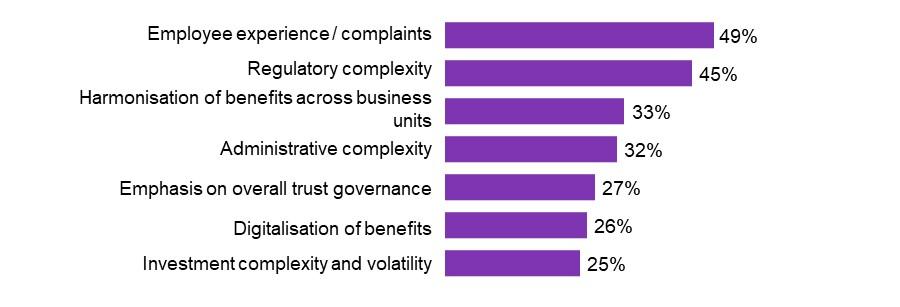

The study also reveals that Employee Experience (49%) is the top influencer of long-term employee benefits strategy, followed by regulatory complexity (45%). Digitalisation of benefits is also ranked amongst the top influencing factors at 26%.

harmonisation of benefits across business units.

Considering the anticipated Labour Code related changes, 71% of companies have taken some action to assess implications. On the other hand, 34% are unsure of making changes to their compensation structure in response to the new definition of wages, while 23% are planning to include variable pay in the wage definition.

In addition, 46% of companies plan to continue contribute 12% of basic salary towards provident fund as prevailing regulations while almost one-third (32%) are unsure of their response.

| Exclude from the definition of wage | Include in the definition of wage | Remuneration in kind | |

|---|---|---|---|

| Stock options (and similar plans) | 72% | 6% | 22% |

| Car leases | 68% | 20% | 12% |

| Variable pay including bonus | 77% | 23% | |

| Travel concessions | 72% | 28% | |

| All travel related components (clubbed into the conveyance allowance) | 76% | 24% |

According to the study, approximately 7 in 10 Employee’s Provident Funds are being managed by a regulator. An equal number of respondents believe that the EPFO services have significantly improved with increased administration efficiency and digital enablement. A large number (73%) also feels that market volatility and the current bond defaults or downgrades have been a cause of increasing concern for their self-managed provident fund. Half the surveyed companies report that regulatory compliance has become a significant burden and a similar number said that managing their own provident fund trust is not a sustainable option in the long-term.

The study found that 73% of the surveyed companies currently provide or plan to implement Corporate NPS and amongst those that already provide it, 61% are exploring strategies to increase the participation rate.

Furthermore, 13% have ported from the Superannuation scheme to NPS, 25% are in the process or are considering to port and 36% offer or plan to offer both. On the other hand, 44% of organisations plan to continue to offer legacy superannuation plans and almost half have retained or are planning to retain the scheme for new entrants. The study also found that 71% are not considering to wind up their Superannuation scheme.

On porting from Superannuation to NPS, companies rank complexity (56%), employee communication (47%) and securing employee consent as top barriers.

Commenting on the study findings, Ritobrata Sarkar, Head of Retirement, WTW India, said: “Organisations are gradually coming out of the pandemic survival mode and focusing on issues such as the long-term implications of retirement adequacy and employee benefits. Our study shows that the retirement benefit landscape in India is evolving, with organisations retaining superannuation as an option in addition to promoting NPS. While both these avenues co-exist, it will be critical for organisations to consider the regulatory environment, flexibility for employees, cost-benefit analysis and most importantly, employee experience as they review their long-term employee benefits strategy and mix. That said, NPS continues to be a focus area with a large majority exploring strategies to increase employee participation rates.”

“A perceived improvement in the EPFO services combined with the bond market volatility and a complex regulatory environment are prompting companies that manage exempt provident funds to consider the feasibility of surrendering their fund to the EPFO,” he added.

At WTW (NASDAQ: WTW), we provide data-driven, insight-led solutions in the areas of people, risk and capital. Leveraging the global view and local expertise of our colleagues serving 140 countries and markets, we help organizations sharpen their strategy, enhance organizational resilience, motivate their workforce and maximize performance.

Working shoulder to shoulder with our clients, we uncover opportunities for sustainable success—and provide perspective that moves you.