Revisit your performance framework to avoid tinkering

An organization’s refined annual operating plan and longer-term strategic plan in a new year spark conversations in the C-suite and boardroom about executive incentives. These conversations include questions like:

Even if raised only for consideration, such questions risk being interpreted as imperatives. If the CEO mentions stock options, HR might think it’s time to include them in this year’s equity compensation awards. Or if a board member says some companies are adding ESG measures, that could be heard by other leaders as a need to add ESG metrics to their own programs.

While these types of modification ideas are offered with best intentions in mind, they too often result in program tinkering. For example, abrupt changes are made to short-term incentives (STIs) without considering the long-term incentive (LTI) plan adjustments made just last year.

This demonstrates an insufficient regard for the overall performance measurement framework that supports the company’s strategy, stakeholder interests and pay-for-performance objectives.

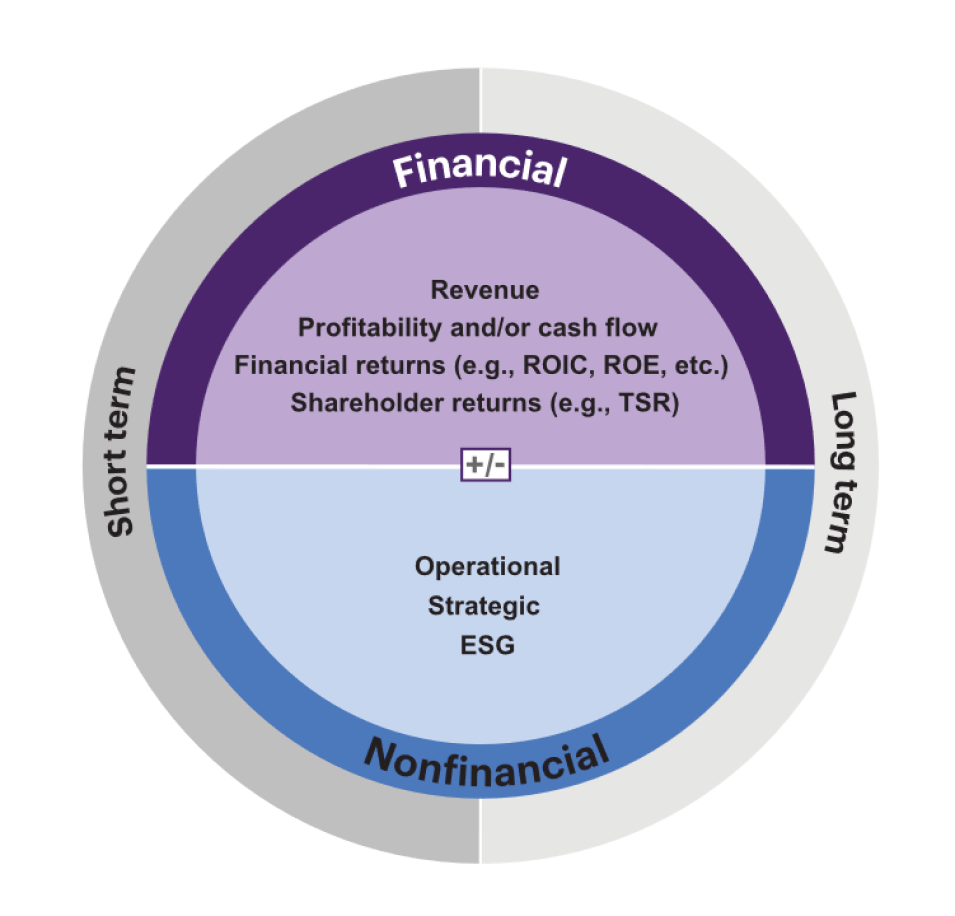

Before acting on these topics of conversation, organizations must revisit their executive incentive program’s performance measurement framework: performance categories, performance metrics, and relative weightings across both STI and LTI. This ensures that the incentive program – and potential changes to it – continues to support the organization’s go-forward strategy (see Figure 1).

Revisiting the framework helps you track both the short term and long term when thinking about the best-fit balance of financial and nonfinancial performance measures. Consider the two following case examples of organizations that went back to their performance measurement roots to deliver incentive programs that made sense for executives as well as the business.

After a recent United Nations Climate Change Conference, a passenger airline company wanted to ensure it was delivering on a commitment to net-zero emissions by 2050. The organization also needed to pursue financial stability after the debilitating effects of the COVID-19 pandemic on air travel.

ESG and financial goals are not exclusive to one another, especially in the world of aviation. In fact, in every industry around the world, stakeholders – including regulators, investors, employees and customers – reward companies that have a credible commitment to the environment.

Given this company’s near-term need for financial stability and longer-term climate commitment, we worked with their compensation committee to develop a performance measurement framework that would withstand conversations raised in the boardroom or among the C-suite. We encouraged the company to:

A food and beverage company that promotes healthier alternative food choices was considering adding ESG metrics to its executive incentives, particularly since the company’s purpose is heavily aligned with environmental and social commitments. Their products are designed to improve human health, promote animal welfare and support environmental preservation. ESG was a natural consideration.

The underlying principles of ESG were already tied to the company’s mission and vision, and it continues to be evident in their operations. For example, environmental goals are achieved with sustainability ingrained in its pipeline and supply chain, from sourcing and manufacturing through to packaging and distribution. Meanwhile, the company pursues its social goals by spreading awareness of their operations and promoting equity and transparency in how they manage their people.

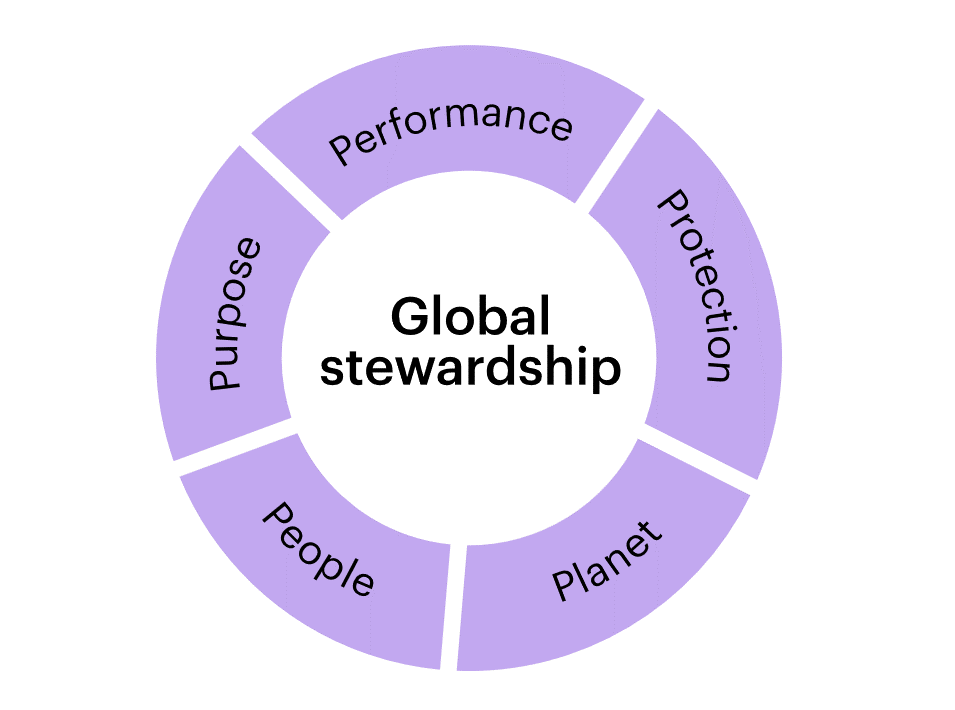

By talking through these in-place efforts, we suggested that ESG metrics are not needed – at least not today – in the executive incentive program. Instead, the company needed strong and sustainable financial performance and value creation driven by market share growth and profitability. In this way, the company could responsibly serve its stakeholders and pursue its broader purpose, in line with WTW’s model for stewardship (Figure 2).

Those two examples highlight the importance of going back to the nature of your business when you plan executive performance incentives. You can start with four actions for aligning your STI and LTI plans to your organization’s objectives.

01

“Typical” practice often is misconstrued as “best” practice. Resist the temptation to believe that. Because your organization competes under its unique service and/or product proposition, your performance measurement framework should support your organization’s strategic pillars and stakeholder interests. Don’t mirror what competitors do with their executive incentive programs; typical practice may not necessarily be the best fit for your organization.

02

Resist buzz and momentum around a particular design du jour among competitors. Instead, ask yourself (and answer) this question: “What are my organization’s most important measures of performance in the coming year and a few years after?” From there, determine what forms of incentives align with and facilitate appropriate rewards for results.

03

Organizations need to carefully examine an overhaul of their executive incentive pay program every few years, or any time the strategic direction shifts substantially. Unless such a shift occurs, avoid tinkering with the program’s overall structure.

04

Every year, ensure your performance measurement framework is still supporting strategic imperatives for the coming year (STI) and the next few years (LTI). Although the executive incentive program’s overall structure should operate as intended, specific performance metrics and weightings should be revisited annually to ensure the program evolves with your organization.

Having a well-thought, defensible performance measurement framework in place allows your organization to cultivate a holistic and sustainable approach to planning executive incentive programs. Once that framework is in place, you can delve deeper into your program’s details and move toward goal setting.

A version of this article appeared in Workspan on January 18, 2024. All rights reserved, reprinted with permission.