How do trustees and sponsors manage the consequences of a global pandemic without precedent? There are many tricky areas to navigate and in this article, we focus on member longevity. The aim is to give trustees and sponsors valuable insight to help with assumption setting and longevity risk management. We do this in two parts – firstly by looking at the latest impact of COVID-19 on the UK population; secondly by providing some practical tips for assumption setting and risk management.

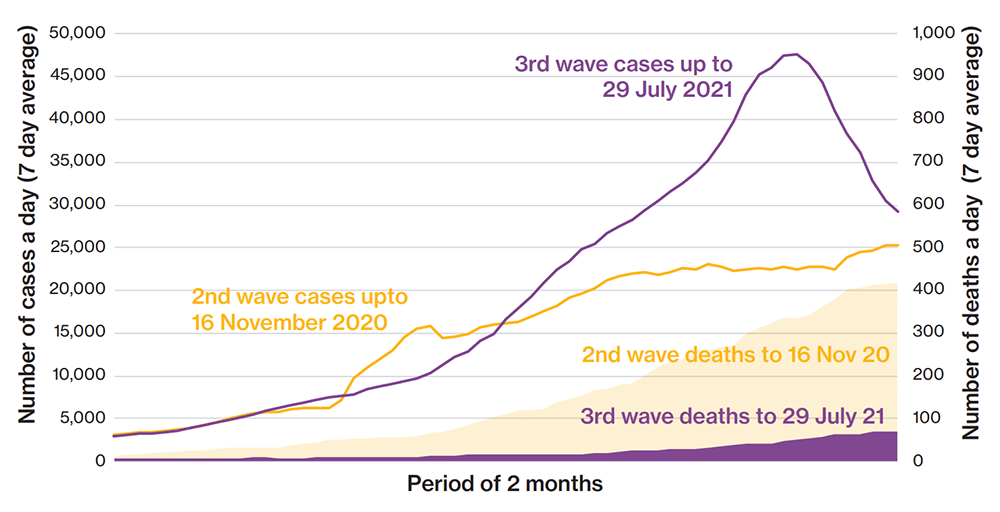

At the time this article was published, the UK was currently in the middle of a significant third wave of COVID-19 driven by the Delta variant. The number of daily hospitalisations and deaths are also rising, but, as shown in Figure 1, less dramatically than in the second wave – case numbers peaked at double the same point in the second wave, but death numbers are only a fifth of the size. Vaccines are undoubtably having a positive effect on the impact of COVID-19. Public Health England estimates that both the Oxford and Pfizer vaccines are over 90% effective at preventing hospitalisation after two doses, and we have now given two doses to over 35 million people1. This is borne out in the average age of those in hospital, thought to be under 50 now and likely to keep reducing as the vaccine roll out continues, compared with around 70 during earlier stages of the pandemic2. And of course, younger people are more likely to survive COVID-19.

Data from Gov.uk. Case numbers based on date reported. Death numbers based on those within 28 days of a positive test by date reported.

It’s becoming clear that COVID-19 is not going away and is likely to become a recurring endemic disease like seasonal flu. Thankfully the data shows we may be able to ‘live with COVID-19’ without the mortality impact and the social and economic disruption of 2020.

“The long-term health complications from COVID-19 are however a significant concern.... this could be a future health crisis.”

The long-term health complications from COVID-19 are however a significant concern. Long-COVID is well publicised and can cause symptoms including tiredness, muscle pain, headaches, insomnia and ‘brain fog’. There is also evidence of long-term organ damage from COVID-19, including to the heart, lungs and brain. Early analysis by the ONS suggests those with COVID-19 related health complications are at a significantly increased risk of health issues including cardiac events, diabetes and chronic kidney and liver damage3. Put another way, there is the potential for a permanent worsening in quality of life and longevity for anyone who contracts COVID-19. With nearly 6 million people in the UK having tested positive for COVID-19 and 1 million having self-reported long-COVID symptoms in May, this could be a future health crisis. On a positive note, there is also early evidence that vaccination can ease long-COVID symptoms4,.

And there are other concerns of course, including: the potential for a glut of cases in the UK or abroad to give rise to a new variant which is more successful at evading current vaccines; the impact of the ongoing pandemic on the diagnosis and treatment of other health issues, including cancer.

The mortality spikes in 2020 and 2021 make measuring true baseline mortality for a scheme population difficult. The easiest solution, which we expect to be common, is to treat these years as ‘blips’ in the data and set scheme or industry baseline mortality on data up to and including 2019. A more complicated approach, which would be expected to give a similar result, is to include 2020/2021 mortality data but to adjust it down using approximate methods to remove the COVID-impact. For those who use a postcode model approach to set baseline longevity, the developers of those models will be doing something similar behind the scenes as and when models are due for their regular update, something we are already preparing for at Willis Towers Watson. Taking one of these approaches doesn’t mean scheme data from 2020 and 2021 should be consigned to the dustbin – separate analysis of this data will help reveal the impact of COVID-19 on your scheme population and provide useful insights about its future impact.

Judgements about the impact of COVID-19 on mortality after 2021 can then be captured using a scheme’s chosen mortality improvement model. These models are however also affected by the COVID-19 mortality spikes because they use trends in recent mortality as the starting point for future improvements. The latest, 2020 version of the commonly used ‘CMI improvement model’ has overcome this issue by allowing users to choose whether data from 2020 is used when calculating future improvements – in other words, do you believe pandemic-type mortality shocks will regularly occur in future and if so how often. Given the significant impact 2020 data has on projected longevity – life expectancy projections that include 2020 data are roughly 5% or 1 year lower – we expect most trustees and sponsors to place close to or zero weight on 2020 data and use other model parameters to reflect their views on the impact of COVID-19 on future longevity. This includes using the ‘initial addition to improvements’ parameter which can be used to adjust the longevity projection up or down over the first 10 to 15 years, and the long-term trend parameter which can be used to set the long-term destination for longevity improvements.

Judging the right adjustment to make, if any, is not easy. Long-COVID, delays in non-COVID-19 health treatment and the possible long-term recessionary effects of the national lockdown all point to a reduction in longevity improvements and overall life expectancy. On the other hand, there are positive factors to recognise. For example, there was almost no flu season during the 2020/21 winter due to social restrictions, saving many lives. This could also happen in future years thanks to public adoption of simple infection control measures like face masks and hand washing, plus greater take-up of the annual flu vaccination. There could also be permanent changes to lifestyle which improve health, for example reduced road traffic pollution if home working continues to be an option for office-based workers.

The appropriate adjustment is likely to depend on the purpose of the assumptions. For company accounting, assumptions are required to be a best guess. Sponsors may reasonably decide that longevity is, on balance, going to fall and so reduce the value of defined benefit liabilities in their accounts. In doing so, they accept the risk they may have to reverse this at a future date should the opposite evidence emerge. For funding and journey planning, trustees in conjunction with the sponsor may show more caution and hesitate from weakening funding targets until that evidence emerges, consistent with the Pensions Regulator’s annual funding statement. A possible corporate challenge might be to ask how long they must wait, given that longevity improvements had already been seen to slow-down significantly for several years pre-COVID. A solution to this natural corporate/trustee tension could be the greater use of contingent funding options (eg escrow accounts) as part of valuation agreements. Such arrangements could help bridge disagreements that might become clearer by the time of the next valuation.

For those on a clear de-risking journey, it is easier to maintain funding targets for now, rather than relaxing them and risking having to re-establish them in future. Nevertheless, it is worth asking your consultant to illustrate scenarios so you can understand how close or far away you could be if life expectancy does in fact increase or fall. For those with a destination of buyout, the most appropriate assumption is clearly what insurers are using. A recent survey carried out by the UK actuarial profession indicates that most insurers are going to put zero weight on 2020 data when using the 2020 CMI improvements model and keep most other parameters unchanged for now.

1. Gov.uk figures

2. ARG analysis of ONS data

3. ONS analysis of adverse events for non-critical COVID-19 hospital patients

4. ARG reporting results of analysis carried out by advocacy group LongCovidSOS