Enhance your global property risk management decision-making

Property Quantified provides you with actionable insights for more informed and effective decision making on your global property risk portfolio. The platform allows you to assess your loss potential and strategically create and execute against an informed risk management strategy.

By evaluating historical catastrophic events and their potential impact on your portfolio, you can make informed decisions about your insurance coverage and risk mitigation strategies.

Property Quantified also helps you answer critical questions:

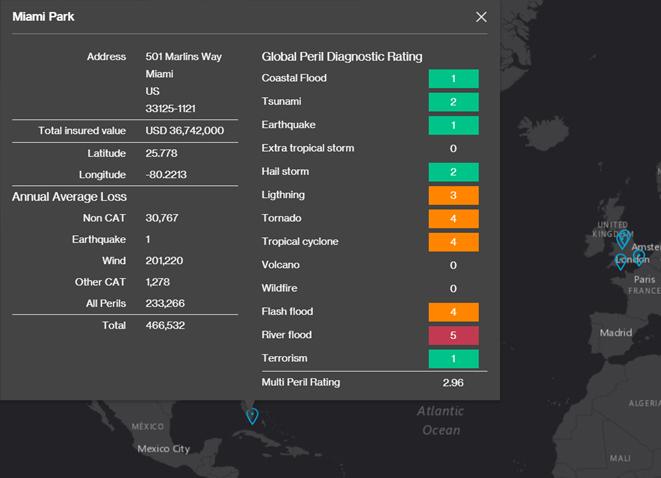

- What's your overall risk exposure? By evaluating location-specific risks and perils, you can understand the level of risk you face across your entire property portfolio.

- How accurate are your risk assessments? By ensuring location data integrity, you can make more informed decisions and have greater confidence in your risk management strategies.

- Where are the vulnerabilities in your property portfolio? Identify facilities where you may need more detailed engineering reports to proactively address potential vulnerabilities.

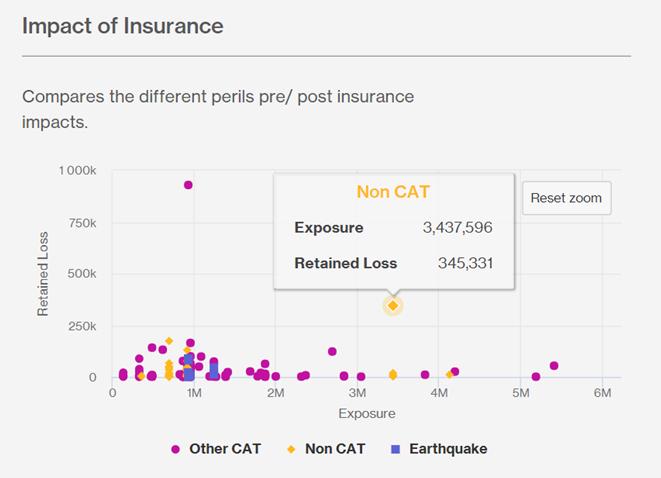

- When does my insurance strategy pay off and how can we optimize our property risk transfer? Sensitivity test various insurance structures and optimize the contingent capital insurance provides.

Go beyond property risk silos to get more value from property risk transfer

Whether you're renewing a property insurance program, considering changes to location-specific insurance coverage, or evaluating property acquisitions or divestitures, Property Quantified provides valuable insight across your entire global property portfolio.

You can move beyond traditional, siloed approaches to global property risk management and take a portfolio view more likely to reveal opportunities for added value from insurance.

Property Quantified can help you avoid over or under insurance, going beyond hazard mapping to give you the analytics to reveal the most efficient limits and deductibles.

You can also use Property Quantified to get a view on the cost of each insurance layer and report on the quantifiable elements of what’s driving your premiums. See which sections of your insurance are most expensive and take deeper dives to understand what’s driving costs.

Property Quantified – key features

- Quantifies both catastrophe and non-catastrophe risks in a single platform

- Interactive platform to view property loss exposure by peril, geography and location

- Comprehensive decision support for creating risk transfer strategies and evaluating quotes

- Delivers a customized view of potential retained losses under different insurance strategies

- Leverages both in-house and vendor data sources and expertise:

- CAT Risk Evaluation: automatic feed from RMS

- Non-CAT Evaluation: WTW loss algorithms

- Other CAT Evaluation: Munich Re’s NATHAN

- A scalable model to evaluate non-catastrophic risks like fire, and catastrophic risks like earthquake, hurricane and flood

- Creates and adjusts insurance strategies for your organization's whole property portfolio, by location or peril, in an interactive platform. Make any change and see the impact to your loss potential immediately

- Understand how historical catastrophic events would affect your portfolio today.

Which organizations can benefit from Property Quantified?

Property Quantified is designed for organizations with locations anywhere in the world.

This tool is useful for any organization considering property insurance or other property risk transfer solutions and wants to explore the risk/return equation.