Willis Towers Watson ESG Beliefs and Practices Survey 2021: Asia

Throughout much of Asia, the COVID-19 pandemic has raised the level of discussion about the need to develop the shoots of a ‘green recovery’. Pronouncements from countries such as Mainland China’s pledge to achieve carbon neutrality by 2060 and South Korea’s promise to end future public funding of coal-fired power plants, have signalled seismic shifts in public policy and areas of investment opportunity across the continent.

“ESG investing should be a strategy in its own right, not just an overlay to other strategies.”

Jayne Bok

Head of Investments, Asia

Willis Towers Watson

As investors in Asia, we have a critical role to play in driving the dialogue around stewardship of finance towards a net-zero and resilient economy. Jayne Bok, Head of Investments Asia, says: “ESG investing should be a strategy in its own right, not just an overlay to other strategies or an adjunct to corporate social responsibility policies. We believe it is crucial to take a broader focus on sustainable investing, which we define as finance-driven, long-term strategies that integrate ESG information and effective stewardship, to make a real world impact.”

In order to define and implement a fitting ESG investment strategy, it is important to understand your current and future ESG strategy and beliefs and how they compare to your peers.

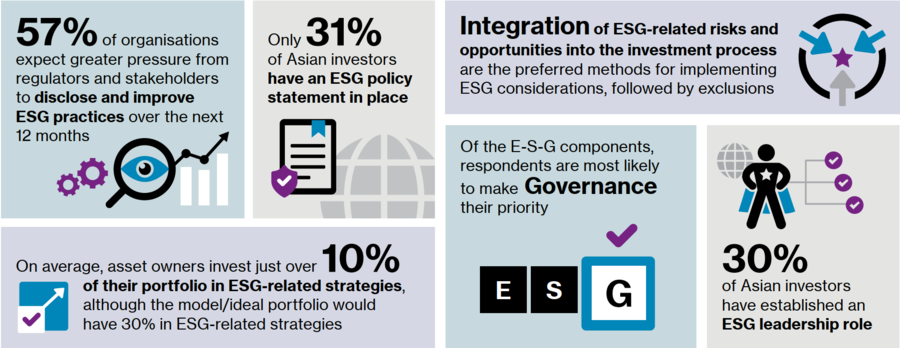

To reflect this increased attention on ESG investing in Asia, we surveyed a cross-section of institutional investors throughout Asia about their investment beliefs, priorities and expectations concerning ESG. Our survey results incorporate responses from 63 organisations; nearly half of those organisations have AuM of over US$1 billion.

Our survey shows that among Asian institutional investors, there is clear expectation that regulatory and stakeholder pressure will strengthen the case for ESG investment and disclosure in the coming years. As a result, asset owners in Asia are also demanding more and better ESG-focused investment products and services to suit their portfolios.

Download our survey report by completing the form on your right, or below on a mobile device, to access our detailed findings from the survey and learn more about the steps you can take in the medium- to long-term to further your ESG journey.