Sustainable investing is about long-term, finance-driven strategies that integrate Environmental, Social and Governance (ESG) factors into the investment arrangements, utilise effective stewardship and have a real world impact. We believe that investors who incorporate sustainable investment practices into their arrangements will likely improve portfolio risk and return outcomes over the long term, and academic evidence supports this view.

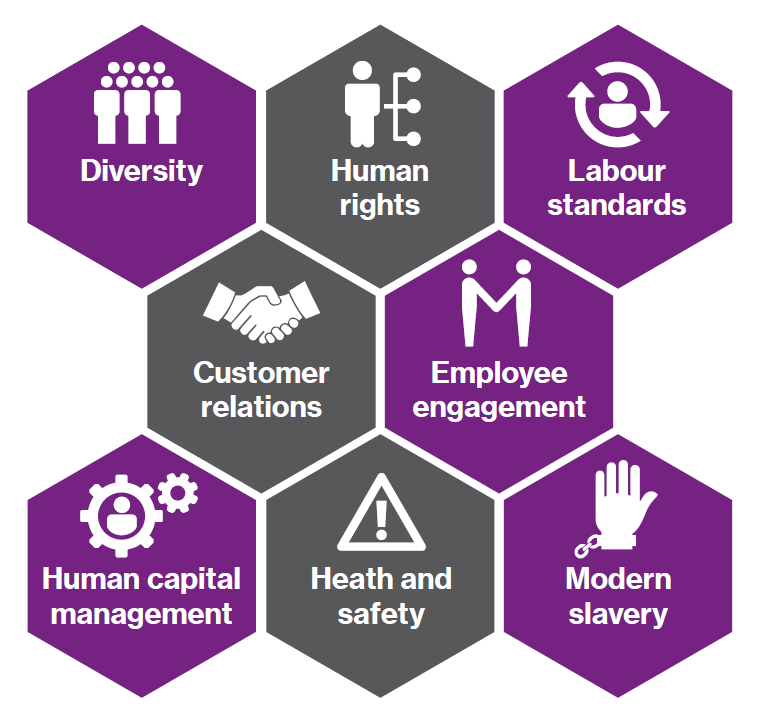

Social factors include topics ranging from employee engagement and customer satisfaction to human capital management:

Historically investors have often focused more on environmental and governance factors, partly due to the challenge of quantifying and measuring social factors. However, the COVID-19 pandemic and the Black Lives Matter movement have led to increased attention on how companies manage social issues, ranging from health and safety to human rights and labour standards. In addition, investors are now better understanding how these issues present clear financial risks and are therefore engaging further in this area.

We believe that investors who integrate ESG factors such as modern slavery into their investment process can improve portfolio resilience by identifying sustainability-related risks and opportunities and then taking action through their portfolio holdings and stewardship activities.

In this paper we focus on the following:

| Title | File Type | File Size |

|---|---|---|

| Sustainable investment practices | .5 MB |