A cheaper way to de-risk?

With many institutional investors continuing to focus on reducing risk relative to liabilities, the demand for index-linked gilts grows. This demand (combined with market conditions) drives up the price investors have to pay for the reasonably secure, long-term cashflows available from index-linked gilts. Katie Sims and Duncan Hale explore SIAs as an alternative approach to sourcing those cashflows while enhancing the return on the overall portfolio.

The actions in recent times of many defined benefit (DB) schemes in de-risking has been a significant factor in making it harder for other schemes to de-risk. The utopian position of being in a well-funded, cashflow-matched position seems increasingly out of reach for many schemes who were not amongst the first to buy index-linked gilts before prices were driven to current high levels.

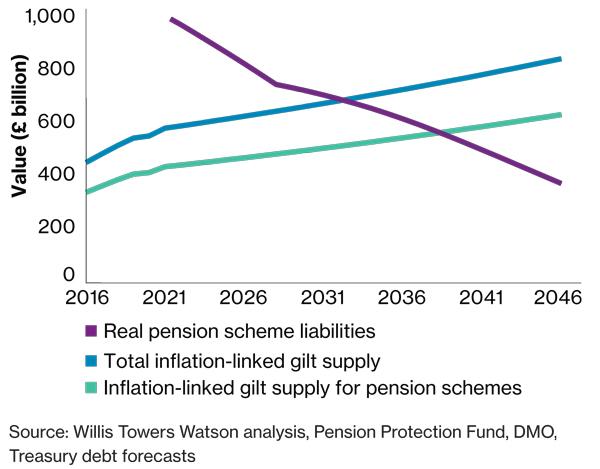

Many are holding out hoping that the position will reverse, particularly as the supportive monetary policy from central banks is expected to start unwinding. However, whilst this may help to bridge some of the gap, there still remains a systemic issue at play. This is that the supply of index-linked gilts is not expected to meet pension scheme demand until about 2040. This imbalance is likely to maintain a downward pressure on real yields for the next few decades. Therefore, investors are desperately searching for high quality, inflation-linked cashflows with a more attractive yield. SIAs fit that bill - they're an ideal component of a DB pension scheme's investment strategy for the following reasons:

To access these benefits we need to exploit the natural competitive advantage DB pension schemes have over other investors and embrace a degree of illiquidity.

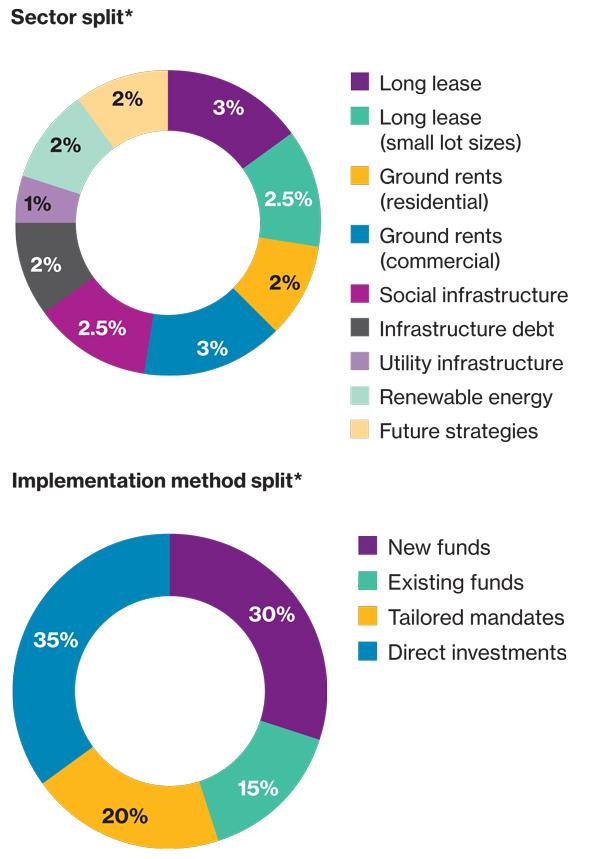

SIAs encompass a wide range of strategies focussed on real estate, infrastructure and illiquid credit. Detailed examples of which can be seen below:

Whilst the underlying assets in a secure income portfolio are not readily traded, there is a healthy secondary market for these assets. In fact, recent experience suggests that a portfolio of high quality SIAs can be traded on the secondary market within a matter of months, sometimes even trading at a premium to the net asset value. That being said, these assets are unlikely to be appropriate for schemes that expect to have a holding period of less than 10 years.

Building a diverse portfolio is key to success in this area. As with any investment, SIAs carry risk and due to the nature of these assets the risks most concerning are the extreme downside ones. Fortunately, SIA investing encompasses a wide range of diversifying assets and strategies, which are not only uncorrelated to traditional assets, but also have low correlation to each other.

Diversity has other attractive benefits too. It can help you deploy your capital much faster than if you invest in a handful of potentially oversubscribed areas of the market, as well as help to improve the portfolio yield. For example, many investors are obtaining exposure to long lease property through very large pooled funds. By necessity, these funds need to bid on large lot sizes and in doing so, face significant competition. By being flexible and working with a specialist investment manager, it is possible to invest in smaller-lot size opportunities that are less competitive, thereby enhancing expected returns by up to 1% per year.

Clearly, there is a limited supply of these assets, even more so than the index-linked gilt market and so you need to be flexible around how you allocate capital in this area. We believe that there will be a first-mover advantage in allocating these assets early, similar to that seen in the index-linked gilt market which we anticipate will encourage investors to act quickly.

Partnering with specialist managers and participating in co-investment opportunities are a critical element of successful execution. Therefore, apart from the larger investors, we typically see schemes outsourcing this portfolio construction and investment sourcing activity.

Finally, as schemes continue to mature and de-risk, the focus will turn to building portfolios of high quality cashflows with a modest premium above gilts as part of a long-term run off solution, or in preparation for an eventual transfer of liabilities to an insurer. So, whilst SIAs can play an important role in your current strategy, their role becomes even more important as your scheme matures.